Event details

With the implementation of new PRC Individual Income Tax (IIT) Law effective as of January 1, 2019, the Ministry of Finance ("MoF") and the State Administration of Taxation ("STA") have successively issued a series of tax circulars and policy interpretations to regulate the specific tax treatment under the new IIT Law.

This includes the detailed explanations on the content of the annual tax reconciliation ("ATR" 年度汇算清缴). Due to its complexity, many companies and individual taxpayers have questions and/or concerns on the new annual tax reconciliation requirement. This seminar will focus on interpreting the key points of the new requirement, significant changes and impacts which will bring to relevant individual employees and employers.

- Provide a brief introduction of the key concepts of new PRC IIT Law.

- Introduce the new ATR filing requirement.

- Interpret detailed requirements including individual filing obligation assessment, tax reconciliation calculation method, filing timeline, filing location, filing procedure, filing forms and tax refund/payment handling etc.

- Discuss the potential impacts on employers and employees within China (incl. responsibilities for all different involved parties in this process) and share the strategies/market practice on how companies and individuals handle the annual tax reconciliation filing.

Price: member - 100RMB | non-memeber - 200RMB

PLEASE NOTE:

- The registration will close at 12PM, March 24th

- Advance payment is required, please find the Payment Method page for more information

- Paid participants will receive a confirmation including the link to join the webinar after 5PM, March 24th

- E-Fapiao will be sent to your email in 5 business days after the event

- This will be a live event and tickets are not refundable

Agenda

- 2:45 PM - 3:00 PMJoining and checking your device and internet connection

- 3:00 PM - 4:00 PMPresentation

Lulu Sang

Senior Manager | People Advisory Services at Ernst & Young (China)

- 4:00 PM - 4:30 PMQ&A

Lulu Sang

Senior Manager | People Advisory Services at Ernst & Young (China)

Jonathan Wagener

Senior Consultant | People Advisory Service at Ernst & Young (China)

Payment Method

Step 1: Please scan the QR below and make the payment.

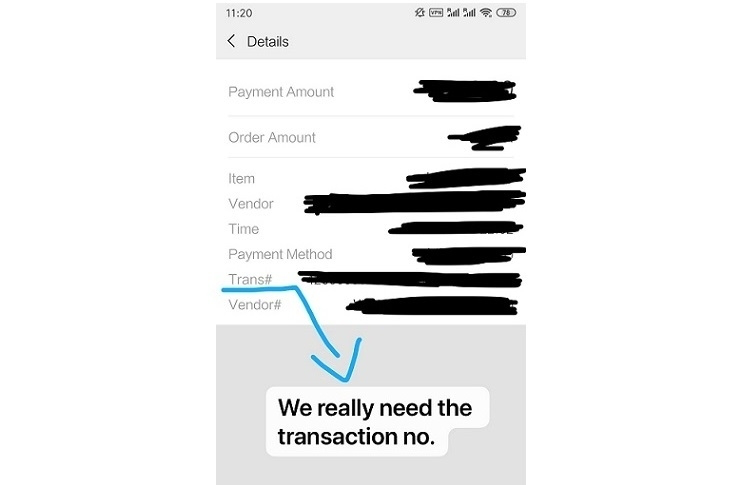

Step 2: When the transaction is completed, please send us the screenshot with the transaction number via email (see below) to GC Events Team (events@bj.china.ahk.de). Otherwise we can't match your payment with your registration.

Organizer

Yearly sponsors

Disclaimer:

© 2020 German Chamber of Commerce in China (GCC). No part of this webinar may be reproduced without prior permission. While every reasonable effort is made to ensure that the information provided is accurate, no guarantees for the currency or accuracy of information are made. All material relating to information, products and services (or to third party information, products and services), is provided 'as is', without any representation or endorsement made and without warranty of any kind, including the implied warranties of satisfactory quality, fitness for a particular purpose, non-infringement, compatibility, security and accuracy. The speakers are solely responsible for the content thereof; In no event will the organizer and/or the speakers be liable for any loss or damage whatsoever arising from infringement or any defect of rights of the content of the webinar. Views expressed are not necessarily those of GCC. All our events follow Chatham House Rules. We are working with [Zoom] to bring this webinar to you. When joining the webinar, you will be bound by Zoom's terms of service, including it's privacy policy which you can download from the [Zoom] website or access through the mobile application. Please note that we have no responsibility for the collection or use of your personal data by [Zoom] or any third party application.